Q2 2025 / Strategy Update & Market Overview

As a reminder of our ongoing commitment to keep you informed, your quarterly performance reports are available on our secure WestEnd Client Portal. You can access it anytime here:

WestEnd Black Diamond Portal

If you need help logging in, contact us directly or visit this page for instructions:

Client Login Information

When we published our Q1 2025 letter in April, the U.S. and China still had 100+% tariffs in place. That already feels like years ago. As trade hostilities unfolded between the two largest economies in the world, we wrote the following:

As it turns out, ‘modicums’ of good news came in rapid succession.

On May 12, after a weekend of negotiations in Geneva, China and the U.S. agreed to de-escalate and pull tariffs back to more sensible levels (30% on Chinese exports and 10% on U.S. exports). In the weeks that followed, the U.S. and U.K. signed a narrow trade deal, Canada repealed its digital services tax, Vietnam purportedly agreed[1] to a tariff rate of 20%, and talks with the EU appeared to be bumping along.

In the 55 trading days from the April 8 low to the new high on June 27, the S&P 500 recorded its fastest recovery from a -15% correction in history. WestEnd was actively re-deploying cash early in this rally.

Our positioning delivered strong relative results for our Core Strategy. In the second quarter, the portfolio generated double the return of the S&P 500 index, driven by our substantial overweight to Technology, Industrials, and select European stocks. We are also outperforming year-to-date.

*Performance values as of June 30, 2025

Please note that these performance figures represent a weighted average of return for each strategy, based on a sampling of actual accounts. The accounts used to measure weighted average performance were generally portfolios that were invested for the entire quarter and were not subject to extraneous factors like scheduled withdrawals, account restrictions, and other factors. The weighted average was based on 131 Core portfolios. Actual performance results may differ from composite returns, depending on the size of the account, investment guidelines and/or restrictions, inception date and other factors. Please see the index disclaimers for the S&P 500 at the end of this review. Past performance is not indicative of future results.

Technology was by far the best performing category in the second quarter (+27.3%), as many of the hardest hit names during the tariff drama also recorded the sharpest recoveries. European stocks have also substantially outperformed U.S. counterparts, with the MSCI Europe rising +23.7% compared to the S&P 500’s +6.2% gain in the first six months. Positioning made a big impact in the quarter, as WestEnd’s largest allocations are to Technology, Industrials, and International (largely European) stocks.

In our June email to clients titled “Tapping into Europe’s Next Chapter of Growth,” we wrote about Ali’s trip to Europe, where he engaged directly with leadership teams at companies that have caught our interest. We informed clients about our trades in Rolls Royce, Adyen, and Rheinmetall.

In this quarter’s letter, we’d like to put the focus on the Industrials theme in the portfolio, given the US government’s increasing focus on bringing more manufacturing and production home (onshoring or reshoring), and the ongoing geopolitical uncertainties due to trade issues, national security concerns, and instability in different regions such as Europe and the Middle East. In short, we’re seeing major capital investment across the aerospace and defense industries, and we think strong earnings growth is very likely to follow.

A key driver is the significant increase in global defense spending, which rose to $2.7 trillion in 2024 (+9.4%) and is expected to keep rising. The U.S. Department of Defense’s 2025 budget request alone totals nearly $850 billion, with meaningful allocations aimed at strengthening industrial capabilities in areas like unmanned systems, hypersonics, and solid rocket motors. Investment is also flowing toward the broader aerospace ecosystem, including modernization of maintenance, repair, and overhaul (MRO) services, where artificial intelligence and predictive technologies are helping to reduce aircraft downtime and improve operational efficiency.

Meanwhile, the rebound in global air travel—up nearly 10.6% in 2024—and structural supply shortages are fueling a wave of commercial aerospace activity. Aircraft manufacturers and suppliers are racing to meet backlogs while also investing heavily in domestic production capacity. For example, GE Aerospace and Howmet stand to benefit from surging demand for more fuel-efficient engines and components made with advanced materials, while firms like Rockwell Automation are playing a pivotal role in enabling digitized, AI-driven manufacturing.

Finally, aerospace and defense companies are positioning for long-term growth by prioritizing supply chain visibility and resilience, given rising concerns over part shortages and delivery delays. In our view, these trends support a robust and durable investment case for quality names across the sector.

Long-time clients may recall our liquidation of Boeing in early January 2024 following the Alaska Airlines door plug incident. We exited at around $227.62.

Following a management shakeup, however, with new leadership under former engineer Kelly Ortberg, we noticed the firm was working to bounce back from safety issues, production problems, and financial losses. The company focus had decisively shifted to quality, stabilizing aircraft output, and rebuilding trust. We viewed Boeing’s commercial side as a turnaround story, accommodated by the steady income provided by the firm’s defense business.

WestEnd began accumulating shares in December 2024 at an average price of $175.47. With strong demand for air travel and a huge backlog of plane orders, delivering aircraft on time is crucial, in which Boeing has demonstrated significant improvement this year. While the latest tragic Air India crash slightly hit the stock, it has recovered as it became apparent that pilot error was the most likely cause. We remain confident that Boeing can further improve execution and take advantage of industry trends like reshoring and increased defense spending, while capitalizing on high demand from China after the country lifted its ban Boeing deliveries due to the temporary tariff truce.

Given our conviction in Boeing’s recovery, we also sought out complementary opportunities—“picks and shovels” plays—that could benefit from Boeing’s resurgence.

Howmet Aerospace stood out.

Beyond its direct connection to Boeing, Howmet is well positioned to benefit from broader sector tailwinds, including rising demand in aerospace and defense and the growing emphasis on building resilient domestic supply chains. As a key supplier of critical components for both commercial and military aircraft, Howmet plays an essential role in supporting next-generation manufacturing. Its expertise in advanced materials and precision engineering makes it a go-to partner for aerospace companies raising quality standards and adopting new technologies. We began building a position in Howmet in early March at an average cost of $130 per share.

Rockwell Automation is another “picks and shovels” investment in the Industrials sector—an established company well-positioned to benefit from reshoring trends, increased defense spending, and the broader adoption of automation and AI in manufacturing. As the economy grows, we expect more industries to invest in faster, smarter, and more reliable production systems, which directly supports demand for Rockwell’s offerings. Its portfolio of automation technologies—including sensors, software, and control systems—helps make domestic manufacturing more efficient and cost-effective. In the defense space, Rockwell also supplies critical systems used in military production facilities.

Unlike Boeing, Rockwell is not a turnaround story. It is already a key enabler of advanced manufacturing and a leader in industrial AI, offering solutions for predictive maintenance, quality control, and digital twins that optimize factory operations with leaner workforces. We saw compelling demonstrations of Rockwell’s technology at Nvidia’s GTC conference in March, which reinforced our investment thesis.

We began accumulating shares of Rockwell in early March at an average price of approximately $271 per share.

We began accumulating shares of GE Aerospace in April of last year, with our current position established at an average cost of approximately $149 per share. Like Boeing, GE stands to benefit from powerful macro trends including reshoring, increased defense spending, and the global rebound in air travel. But unlike Boeing, GE is not a turnaround story. The company has already successfully repositioned itself as a focused aerospace leader. It’s investing heavily in U.S. factories and suppliers to expand production capacity, improve supply chain resilience, and support reshoring initiatives.

GE also plays a critical role in defense. On the commercial side, it powers the majority of widebody aircraft in North America and holds a dominant position in the narrow-body segment through its joint venture with Safran Aircraft Engines, CFM International. GE’s high-margin engine MRO business is another bright spot, poised for growth as airlines extend the life of existing aircraft. In effect, GE benefits both from Boeing’s recovery and from broader structural demand in aviation.

We also see GE as an innovation leader—applying AI and digital tools to improve predictive maintenance, streamline inspections, and enhance manufacturing processes. Altogether, our investment in GE reflects confidence in a stable, future-focused company that’s positioned at the center of global aerospace and industrial growth.

Looking Ahead

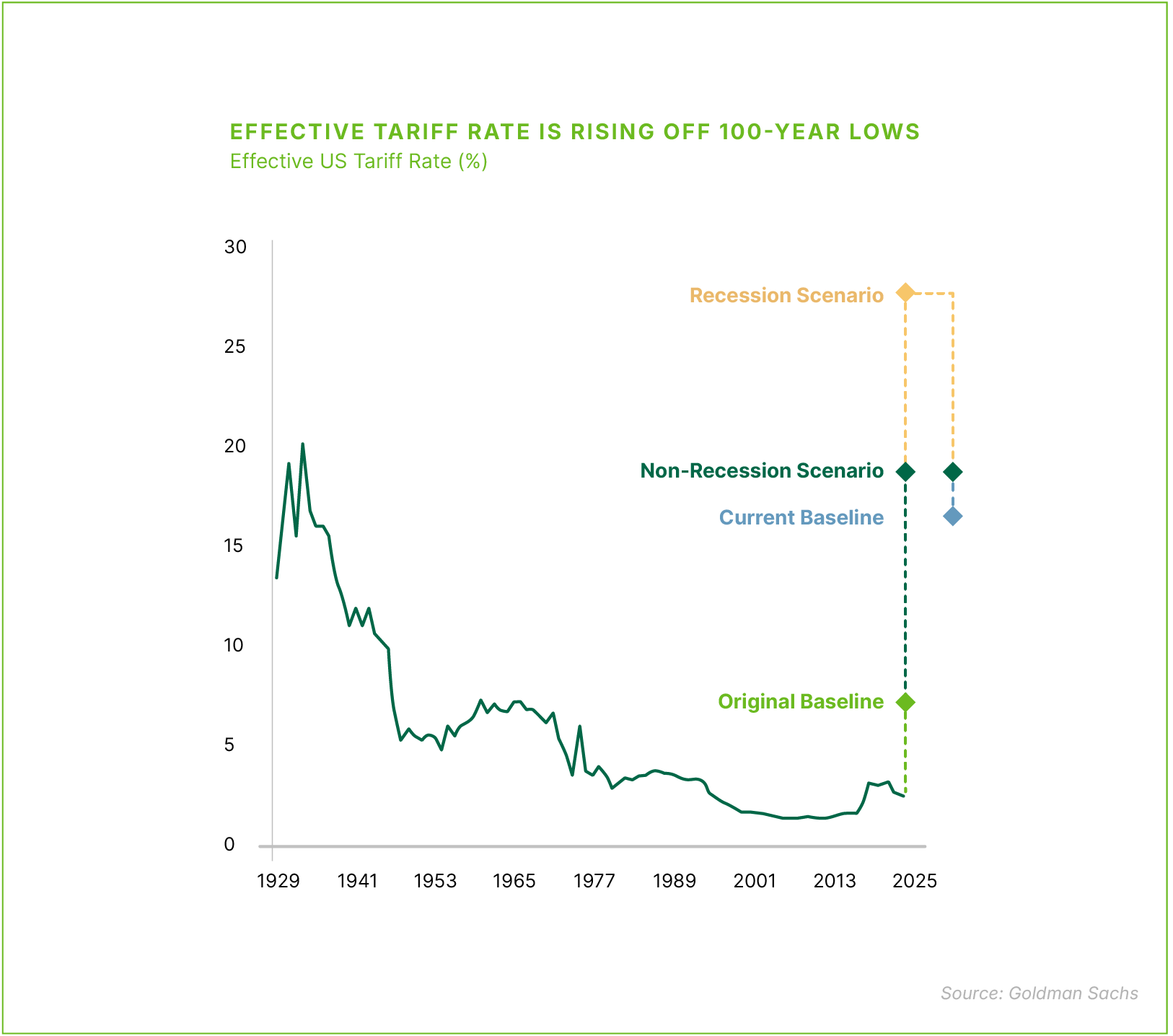

It is apparent to us that markets have moved past the worst-case scenario version of the tariff story, seeming to accept that the U.S.’s effective tariff rate will be higher but not so high as to trigger a recession (see chart on next page). The Trump administration’s familiar pattern of delaying implementation of tariffs and framing small agreements as ‘deals’ is a signal to markets that the overall strategy is less about inking major trade deals (which take years to complete) and more about extracting concessions.

Meanwhile, we also saw the passage of major U.S. fiscal stimulus with the One Big Beautiful Bill Act (OBBBA). There’s been much debate over the size of the bill, its price tag, and its potential effect on deficits and U.S. debt. We won’t rehash those arguments here. Markets in the short term did not appear very fazed by its passage. Many believed the bond markets would go haywire at the prospect of soaring debt combining forces with inflationary pressures from tariffs. But as seen on the chart on the next page, the yield on 10-year U.S. Treasurys has barely nudged while liquidity rose by $400 billion. This was yet another bullish catalyst for stocks in the quarter.

Provisions in OBBBA could bolster corporate earnings, which may neutralize some of the tariff headwinds. These include expensing for capital equipment and R&D investments, more favorable treatment of interest expenses, and full write-offs for new factory construction. Together, these measures could incentivize a wave of domestic investment, particularly in manufacturing and technology-intensive sectors, generating hundreds of billions of dollars in savings. We think the Core Strategy is well-positioned for these tailwinds.

If you have any questions about this review or your portfolio, please do not hesitate to reach out to us directly. Thank you for your continued confidence, and we hope you’re enjoying your summer.

[1] The Vietnam agreement was announced on President Trump’s social media account, but no text or supporting documents have been released as of this writing.

Notes and Disclaimers

i Important Account Minimum Reminder: Per our management agreement, WestEnd Capital maintains a minimum account size of $500,000. If the Rheinmetall trade was not executed in your account, it is likely due to your account not meeting this minimum threshold. We remain committed to providing tailored guidance and appropriate opportunities based on each client’s individual portfolio. If you have any questions about your account or how this may apply to you, please contact us.

________________________

This newsletter has been prepared solely for the client to whom it was directed and may not be sent to any other party. Further, it contains highly confidential and proprietary information and trade secrets that are of independent, economic value to us. Any disclosure of this information could cause us competitive harm. By accepting this newsletter, you agree to keep strictly confidential all of its contents and may not reproduce, distribute, share or publish in any manner without our prior written consent. This letter is not, and is not intended to be, an advertisement within the meaning of Advisers Act Rule 206(4)-1.

Further, a substantial part of this newsletter contains forward-looking statements within the meaning of the federal securities laws, including in particular statements appearing on page 3. Forward-looking statements are those that predict or describe future events or trends and that do not relate solely to historical matters. For example, forward-looking statements may predict future economic performance, describe plans and objectives of management for future operations and make projections of revenue, investment returns or other financial items. A prospective investor can generally identify forward-looking statements as statements containing the words “will,” “believe,” “expect,” “anticipate,” “intend,” “contemplate,” “estimate,” “assume” or other similar expressions. Such forward-looking statements are inherently uncertain, because the matters they describe are subject to known (and unknown) risks, uncertainties and other unpredictable factors that are beyond our control. Actual results could and likely will differ, sometimes materially, from those projected or anticipated. We are not undertaking any obligation to update or revise any forward-looking statements whether as a result of new information, future events or otherwise. You should not take any statements regarding past trends as a representation those trends or activities will continue in the future. Accordingly, you should not put undue reliance on these statements.

In preparing this newsletter, we have relied upon information provided by the custodian(s) and other third-party sources we believe to be reliable and accurate.

Past performance does not guarantee future results. Different types of investments involve varying degrees of risk and there can be no assurance that the future performance of any specific investment or investment strategy will be profitable. Changes in investment strategies, contributions or withdrawals, and economic and market conditions will materially alter the performance of your account. All investing involves risk of loss including the possible loss of all amounts invested.

Index Disclaimers

The benchmarks referenced are included to reflect the general trend of the markets during the periods indicated and are not intended to imply that the underlying returns were comparable to the market indices either in composition or element of risk. There are significant differences between client accounts and the indices herein including, but not limited to, risk profile, liquidity, volatility, and asset composition.

The S&P 500 Index is a capitalization-weighted index comprised of 500 stocks chosen for market size, liquidity and broad industry group representation within the U.S. economy. Index returns represent gross returns, and are provided to represent the investment environment during the time periods shown and are not covered by the report of the independent verifiers.