Q4 2025 / Strategy Update & Market Overview

Quarterly Reports – Now Posted

Check your WestEnd Black Diamond Portal for the latest performance report through the most recent quarter’s end.

If you need help logging in, contact us directly or visit this page for instructions: Client Login Information

It’s been a strong few years for stocks.

Since the end of the bear market triggered by rising inflation and interest rates in 2022, equities have delivered strong appreciation driven in large part by the AI theme. WestEnd committed to the AI trade early, and we captured outsized gains by actively investing in some of the key players driving AI innovation and infrastructure buildout.

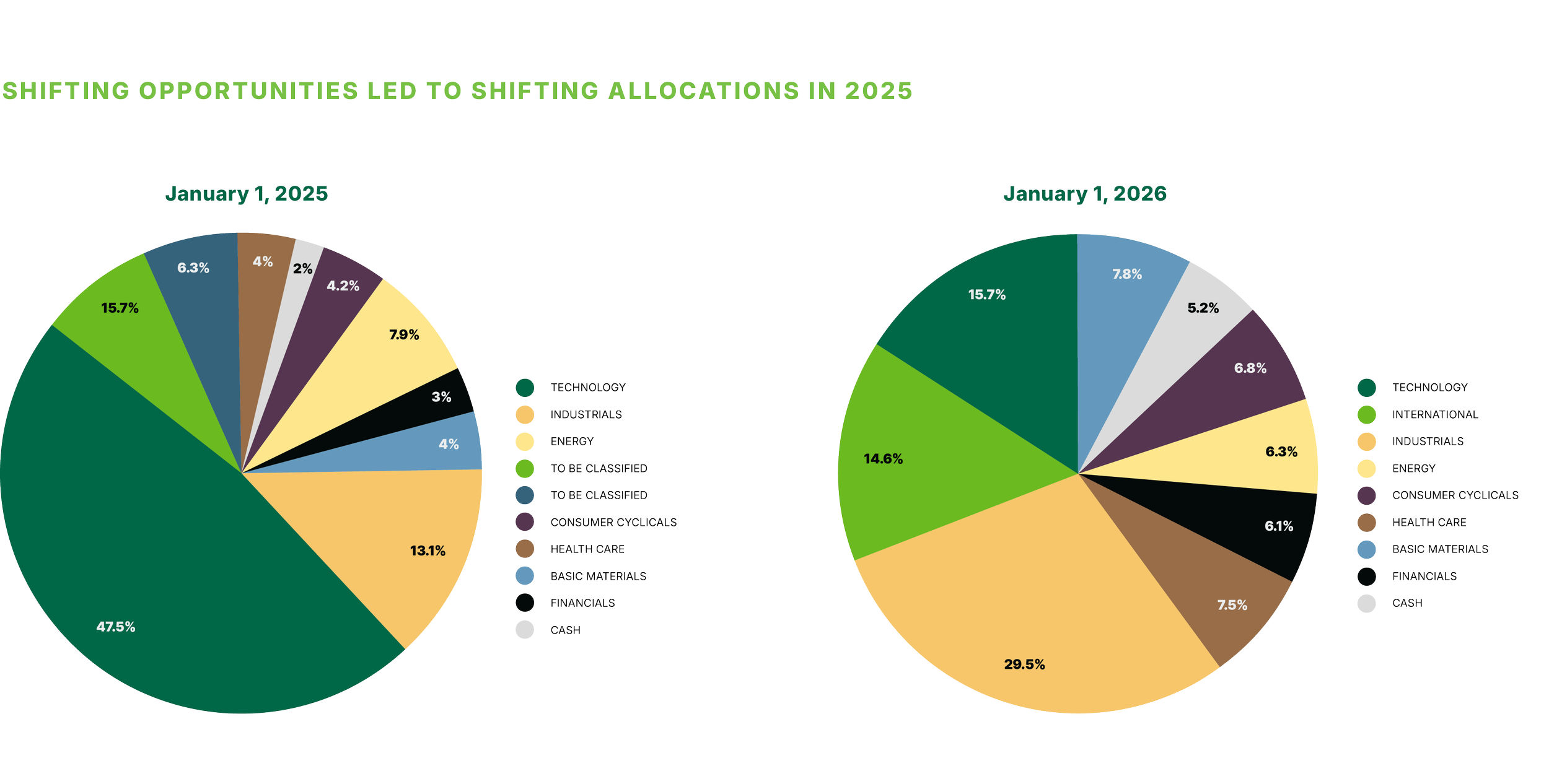

At the outset of 2025, our large (47.5%) Technology weighting reflected our continued belief that the strongest and most durable earnings growth would remain concentrated in the AI theme. By the end of the year, however, it became apparent that many leading companies carried above-average growth expectations and index weights, which can create vulnerabilities. And while corporate balance sheets remain strong in aggregate for Technology companies in the S&P 500—and we don’t see the AI boom going anywhere—it’s also true that debt financing is likely to become a more important contributor to funding the AI buildout. As capital intensity rises, so too does the need for sustained earnings growth to justify ongoing investment. This was a key reason we sold Meta after booking strong gains.

As 2025 progressed, we identified a growing number of compelling opportunities outside of mega-cap Technology. The most visible year-over-year change is the increase in Industrials and International exposure. This shift reflects an expanding opportunity set in areas where we see multi-year investment cycles playing out, like advanced manufacturing, aerospace/defense supply chains, and global infrastructure buildout. These are theme-driven areas, but the portfolio changes were ultimately driven by individual security selection, where we believe company-specific execution and earnings potential remain underappreciated.

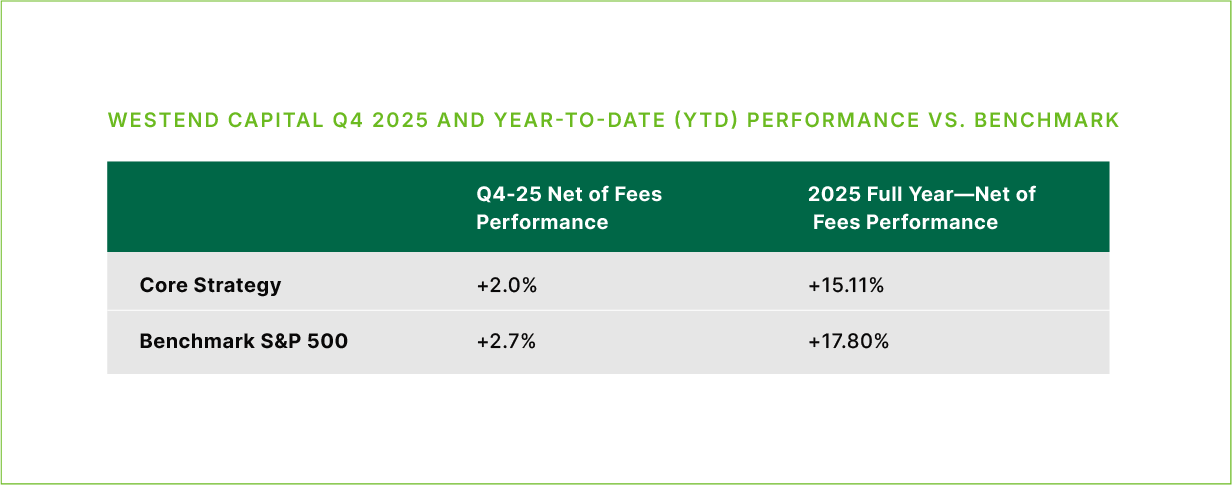

Returns for full-year 2025 were solidly positive, with WestEnd’s Core Strategy slightly underperforming the S&P 500. Some of the biggest winners over the past year are also among our biggest positions currently, including names like Boeing, GE Aerospace, and Cameco.

*Performance values as of December 31, 2025

Please note that these performance figures represent a weighted average of return for each strategy, based on a sampling of actual accounts. The accounts used to measure weighted average performance were generally portfolios that were invested for the entire quarter and were not subject to extraneous factors like scheduled withdrawals, account restrictions, and other factors. The weighted average was based on 131 Core portfolios. Actual performance results may differ from composite returns, depending on the size of the account, investment guidelines and/or restrictions, inception date and other factors. Please see the index disclaimers for the S&P 500 at the end of this review. Past performance is not indicative of future results.

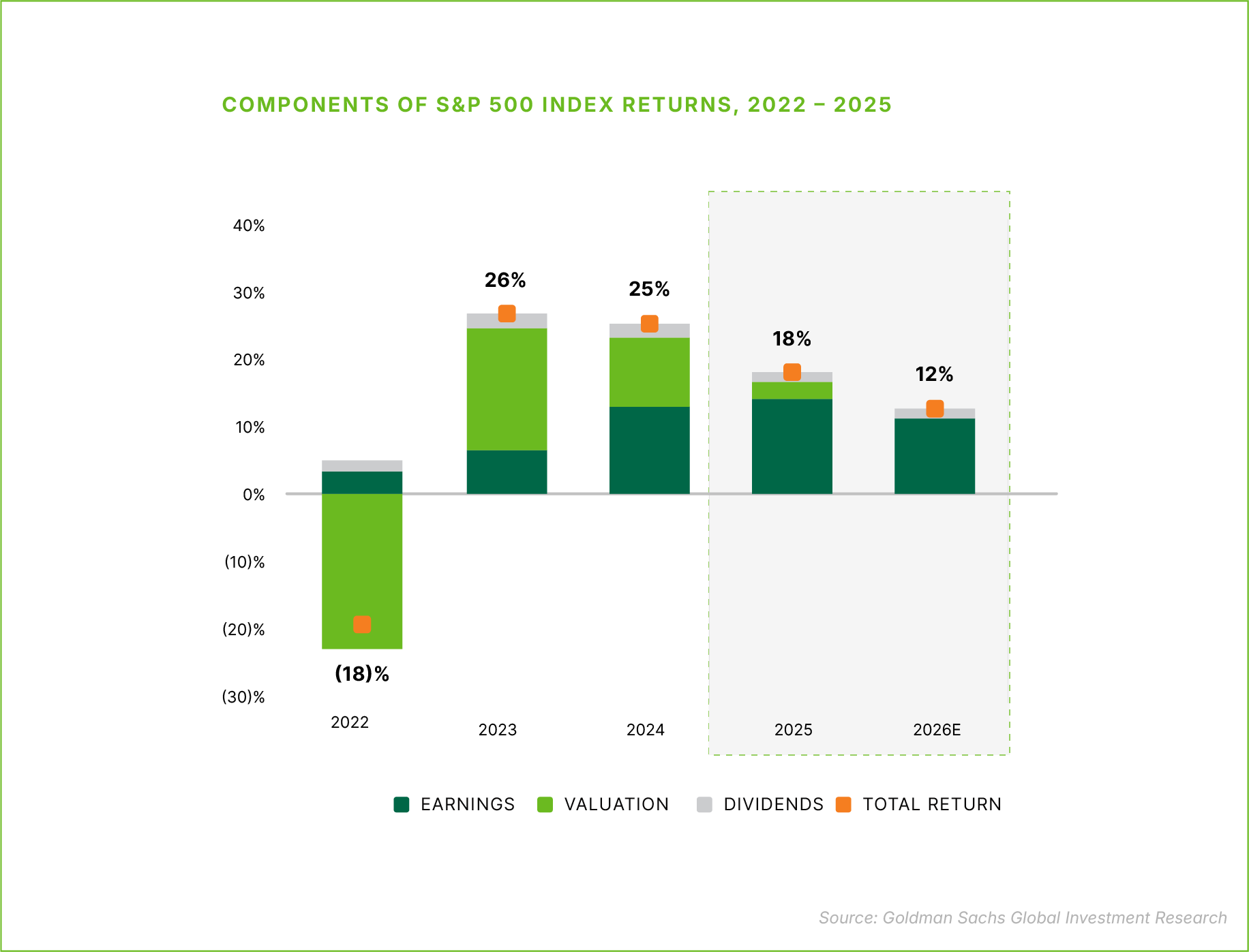

As markets continued to rally through the summer, attention shifted from tariff/macro fears toward valuation concerns, particularly in large-cap technology and AI-related stocks. The term “AI bubble” started to appear everywhere. This created some concern about a top-heavy market, understandably. But the fundamentals in 2025 were starkly different than the media narratives. Last year, market gains were not being driven by excessive risk-taking and multiple expansion. Perhaps surprisingly, the bulk of equity market appreciation (14% of the 18% of the S&P 500’s gain) came from earnings growth.

U.S. corporations enter 2026 with another strong earnings outlook, which we think could be supported even further by accommodative fiscal and monetary policy.

Total job gains in 2025 averaged fewer than 50,000 per month, which marked the slowest pace outside of recessions since the early 2000s. The other side of the Fed’s ledger, inflation, continues to look like less and less of a problem. Core inflation remained elevated in 2025 largely due to tariff pass-through effects. But excluding tariffs, underlying inflation continued to trend lower, supported by easing shelter costs and moderating wage growth.

Setting aside the growing tension between the White House and the Federal Reserve, we think the Fed finds itself in a more flexible position on rates based on the data above. With steady inflation and labor market momentum slowing, the outlook on policy remains skewed toward further easing rather than renewed tightening.

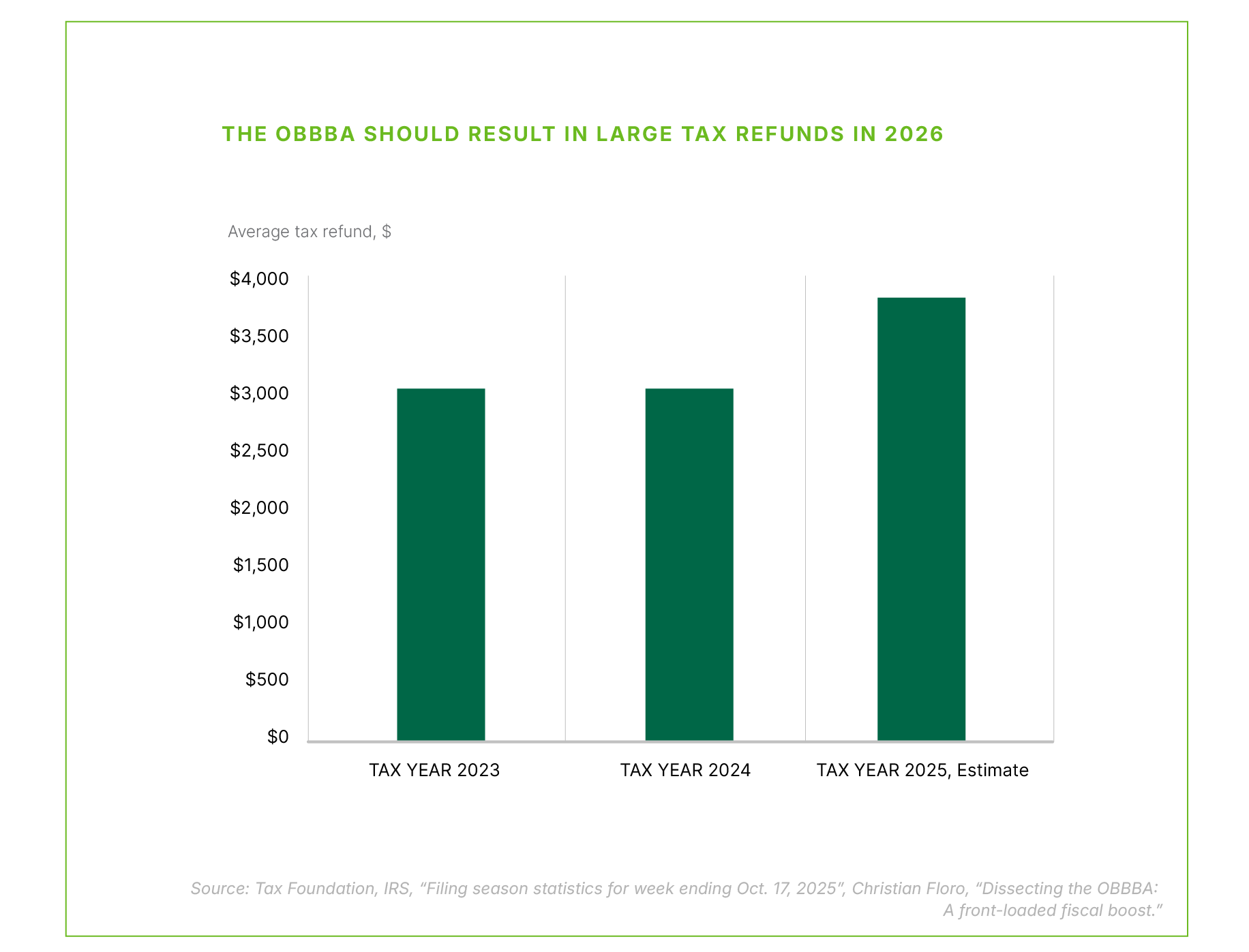

Fiscal policy is also likely to remain a constructive part of the backdrop. The Trump administration has signaled its intent to dial-up fiscal stimulus in various forms, and the impact of the OBBBA should provide meaningful financial/tax benefits for businesses and households this year (see chart below). To the extent these policies encourage capital formation and business investment, they can help sustain demand and drive spending and earnings in the new year.

Notable Buys in Q4 2025

Kodiak Gas Services

Kodiak Gas Services is a ‘picks‑and‑shovels’ play on the U.S. natural gas boom. The company provides mission‑critical large‑horsepower compression infrastructure that sits upstream of LNG exports and downstream power demand from AI‑driven data centers.

In our view, Kodiak’s long‑term, take‑or‑pay style contracts, high fleet utilization, and structurally tight compression market can translate robust demand in the Permian and other basins into steady EBITDA growth, rising discretionary cash flow, and a high‑single‑digit total return profile before any multiple expansion.

Q3 2025 revenue was about $323 million, with Contract Services revenue near $297 million

Adjusted EBITDA of roughly $175 million (54% margin), and discretionary cash flow up low‑teens year over year

5+% dividend

Eli Lilly

Eli Lilly stands out as a dominant franchise in the GLP-1 obesity and diabetes market, while actively reducing friction for patients and payers through direct-to-consumer and direct-to-employer pricing strategies that bypass pharmacy benefit manager (PBM) middlemen.

Through “LillyDirect,” cash-pay patients can now access Zepbound vials at $299–$449 per month depending on dose—well below the $1,086 list price—and the company is piloting a direct-to-employer model with Waltz Health that could pressure PBMs to lower fees and widen access further.

Lilly also struck a deal with the Trump administration to bring Zepbound to certain Medicare enrollees for $245 per month and will offer discounted medications through the TrumpRx platform, underscoring a structural shift toward price transparency and volume growth over middleman margins.

Beyond metabolics, Lilly is diversifying into oncology and next-generation oral GLP-1s that could extend its competitive moat. The company's oral GLP-1, orforglipron, is a small-molecule drug, allowing patients to take it any time of day without fasting requirements, a meaningful convenience advantage over Novo Nordisk's Oral Wegovy. Lilly expects FDA approval by March 2026, with GlobalData forecasting orforglipron as a mega-blockbuster generating $13 billion in annual sales by 2031.

Caterpillar

Caterpillar is increasingly a software‑ and data‑driven industrial platform rather than a pure iron manufacturer, using connected machines, cloud analytics, and AI to grow high‑margin services and smooth out cyclicality in equipment sales.

The company has built a unified digital platform, Helios, to standardize data from more than 1.4 million connected assets and is targeting $28 billion in services revenue by 2026, leveraging offerings like VisionLink fleet monitoring, Cat Inspect, and Cat Central to deepen customer relationships and increase aftermarket spend by up to 33%. At CES 2026, Caterpillar showcased an AI‑powered future, including a Cat AI Assistant and agentic AI tools that use this data backbone to enable predictive maintenance, autonomous operations, and digital twins, further entrenching Caterpillar at the center of its customers’ workflow and decision‑making.

Within this broader digital ecosystem, Caterpillar’s dealer network is also adopting best‑in‑class data tools, which is where Palantir comes into the picture. WesTrac, one of Caterpillar’s largest dealers in Australia, is deploying Palantir Foundry across its service and rebuild centers to integrate siloed data, build a richer digital twin of workshops, anticipate bottlenecks, and optimize labor and inventory—directly improving uptime and lifecycle economics for Cat equipment owners.

Century Aluminum

Century Aluminum sits at the intersection of two powerful secular currents: the AI data‑center buildout, and a renewed focus on defense and energy security. Both factors are structurally metal‑intensive and increasingly favor domestically sourced supply.

On one hand, hyperscale AI facilities require up to 20,000 tons of steel, massive amounts of aluminum for racks and cooling, and as much as 50,000 tons of copper per site (one reason for our re-entry into Freeport McMoran). Within aluminum specifically, the boom in data centers, EVs, and clean‑energy infrastructure is already tightening the U.S. market, pushing up the Midwest premium and incentivizing long‑idled domestic smelting capacity—exactly where Century operates—to restart and reinvest.

Century is repositioning itself as a strategic U.S. metals asset leveraged to AI and defense spending, rather than just a cyclical aluminum producer. The company has announced roughly $50 million to restart idled Mt. Holly capacity and has secured long‑term power contracts to protect margins in a world where Big Tech is willing to pay far more for electricity, effectively competing with smelters for grid access.

Century’s focus on high‑purity primary aluminum directly ties into national security needs as well, as this material is essential for military aircraft, armor plate, drones, and advanced weapons systems.

Conclusion

In 2025, we continued to participate in the now long-running artificial intelligence theme, but we also broadened exposure to industrial modernization, global defense spending, and health care as new opportunities emerged outside of mega-cap Technology. The result is a portfolio that is more balanced across sectors and geographies, but remains anchored to companies we believe have durable competitive advantages and long runways for earnings growth.

Looking ahead to 2026, we believe the investment environment remains constructive. Corporate balance sheets are generally healthy, earnings expectations are solid, and both fiscal and monetary policy appear more supportive than restrictive. We see plenty of opportunity on the horizon.

As always, we appreciate your continued confidence in WestEnd Capital Management, and we encourage you to reach out with any questions regarding this review or your portfolio. Thank you for being clients.

Notes and Disclaimers

This newsletter has been prepared solely for the client to whom it was directed and may not be sent to any other party. Further, it contains highly confidential and proprietary information and trade secrets that are of independent, economic value to us. Any disclosure of this information could cause us competitive harm. By accepting this newsletter, you agree to keep strictly confidential all of its contents and may not reproduce, distribute, share or publish in any manner without our prior written consent. This letter is not, and is not intended to be, an advertisement within the meaning of Advisers Act Rule 206(4)-1.

Further, a substantial part of this newsletter contains forward-looking statements within the meaning of the federal securities laws, including in particular statements appearing on page 3. Forward-looking statements are those that predict or describe future events or trends and that do not relate solely to historical matters. For example, forward-looking statements may predict future economic performance, describe plans and objectives of management for future operations and make projections of revenue, investment returns or other financial items. A prospective investor can generally identify forward-looking statements as statements containing the words “will,” “believe,” “expect,” “anticipate,” “intend,” “contemplate,” “estimate,” “assume” or other similar expressions. Such forward-looking statements are inherently uncertain, because the matters they describe are subject to known (and unknown) risks, uncertainties and other unpredictable factors that are beyond our control. Actual results could and likely will differ, sometimes materially, from those projected or anticipated. We are not undertaking any obligation to update or revise any forward-looking statements whether as a result of new information, future events or otherwise. You should not take any statements regarding past trends as a representation those trends or activities will continue in the future. Accordingly, you should not put undue reliance on these statements.

In preparing this newsletter, we have relied upon information provided by the custodian(s) and other third-party sources we believe to be reliable and accurate.

Past performance does not guarantee future results. Different types of investments involve varying degrees of risk and there can be no assurance that the future performance of any specific investment or investment strategy will be profitable. Changes in investment strategies, contributions or withdrawals, and economic and market conditions will materially alter the performance of your account. All investing involves risk of loss including the possible loss of all amounts invested.

Index Disclaimers

The benchmarks referenced are included to reflect the general trend of the markets during the periods indicated and are not intended to imply that the underlying returns were comparable to the market indices either in composition or element of risk. There are significant differences between client accounts and the indices herein including, but not limited to, risk profile, liquidity, volatility, and asset composition.

The S&P 500 Index is a capitalization-weighted index comprised of 500 stocks chosen for market size, liquidity and broad industry group representation within the U.S. economy. Index returns represent gross returns, and are provided to represent the investment environment during the time periods shown and are not covered by the report of the independent verifiers.